“Check, please”

The prices of the food and drinks in restaurants are listed on the menu for all to see. In contrast, in the U.S. health care system, the prices of health care services are unknown to patients and many who work within health care. The lack of price, or cost, information is complicated by a wide variation in charges, often presented in complex bills or as part of “explanation of benefits” forms received by the 90% of Americans who have some health insurance (private or public) that pays a portion or all of the bills.1 Those with insurance may face bills from doctors, hospitals, and other providers outside their insurance network, while uninsured patients receive bills that, for reasons explained in this policy brief, are usually not intended for the patients themselves.

This is the second in a series of briefs about the problems of “cost” in health care, how cost problems may be defined, and how public policies can achieve meaningful and realistic solutions. This brief identifies the systemwide challenges created by relatively low Medicare and Medicaid payment rates that do not fully cover provider costs, with higher rates from private insurers making up the deficit and ultimately being borne by patients and employers through higher premiums and out-of-pocket payments.

No More Surprises?

While variations in prices charged for health care services have frequently been identified as a problem in the United States, public policies targeting pricing have most often focused on transparency rather than setting caps or standard payment rates.2 Recently, national attention has focused on the more limited issue branded as “surprise billing.” The first nationwide law prohibiting surprise billing by medical providers, the No Surprises Act, took effect Jan. 1, 2022. This law provides financial protection for some patients caught between insurers and providers in a complex, uneven health care financing system.

The No Surprises Act is meant to prevent patients from having to unexpectedly pay large bills from out-of-network health care providers in emergency and some nonemergency situations.3,4 Yet, the legislation is unlikely to alter a fundamental problem: Unlike the prices at restaurants, charges from hospitals and physicians are not uniform by customer (patient or payer). Providers instead charge “list prices” intended for private payers — not patients — as the beginning of a negotiation process in which providers attempt to recover the unpaid costs of care delivered to patients with Medicare and Medicaid or with limited or no insurance coverage.

Sometimes, the Bill Doesn’t Add Up

For the third of the U.S. population covered by Medicare or Medicaid, the federal or state government sets payment rates for specific health care services, and there is no negotiation (unless we count lobbying Congress and the executive branch by provider organizations as negotiating). Individual patient out-of-pocket costs are a portion of this payment, in the form of deductibles, coinsurance, or copays, depending on each patient’s specific coverage. These out-of-pocket costs can be significant and prohibitive for many patients and their families.

When a privately insured patient uses the same health care services Medicare and Medicaid patients use, doctors and hospitals generate charges that may be inflated several-fold compared with costs, depending on the provider and the type of service being offered. These charges represent a provider’s opening bid in contract negotiations with private health insurance companies even when established negotiated rates are in effect. These charges rarely reflect what the insurer pays or what insured patients pay out of pocket.5-7 Each provider negotiates specific rates each private health insurer will pay for a given service (typically, a percentage discount on the charges), and patient out-of-pocket costs are a portion of this negotiated rate.6 This situation leads to a billing system with variable payments that depend not only on the provider but also on who is paying for the service.8 The ratio of charges to costs can be as high as 10 to one for some hospitals and is generally higher at for-profit institutions.7

For people who are underinsured or uninsured, hospital and physician bills often reflect the full charges rather than discounted rates, such as those negotiated by private insurers.9 Bills with such charges can be agonizing, as uninsured patients usually do not have the leverage that insurance companies have to negotiate lower bills.10 A total of 10% of nonelderly people in the United States are uninsured, and many patients with insurance also face skyrocketing out-of-pocket costs due to the proliferation of narrow-network (that is, networks with a limited number of providers and services) and high-deductible health plans over the past decade.11 Almost half of patients — both insured and uninsured — say they have difficulty paying their health care bills.12

The Real Problem Is the Disconnect

Given the high list prices and the complexity of medical bills, lawmakers have increasingly focused on improving the transparency of hospital bills and payments. However, constraining list prices does little to reduce the actual costs of hospital care, nor does it reduce the amount insurance companies and patients eventually pay.

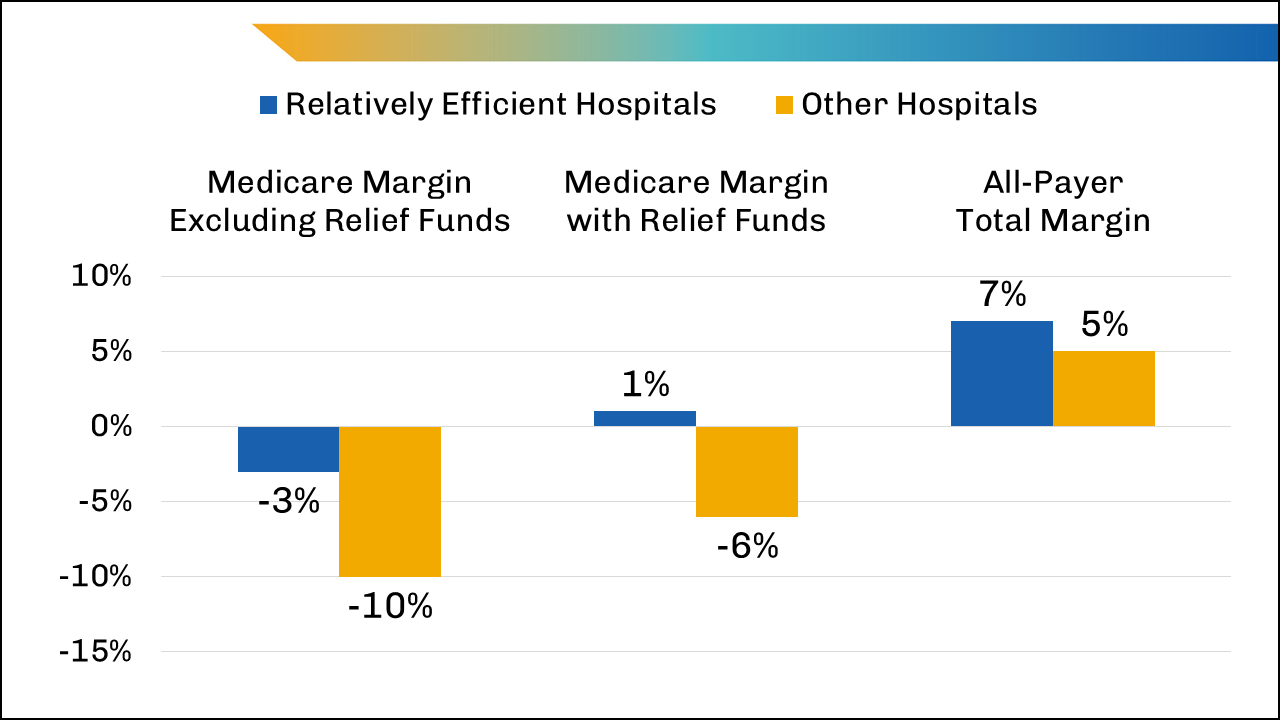

The real problem is the disconnect between the actual costs required to deliver patient care and the rates paid by third-party payers, whether public or private. Medicare and Medicaid payment rates are set by federal and state governments and have been lower than the costs reported by hospitals since 2000.5 Medicare covered less than 84% of average hospital costs in fiscal year (FY) 2020, whereas Medicaid covered 88% of average hospital costs that year.13 Health economists often argue that hospitals lose money only because their inefficiency elevates their costs and that hospitals could make money even from the relatively low payment rates offered by Medicare. However, the Medicare Payment Advisory Commission found that in 2020, before relief funds related to COVID-19 care were added, even the 15% of hospitals deemed relatively efficient had costs higher than Medicare’s payments and lost 3 cents on every dollar of care delivered to Medicare inpatients (Figure 1).14

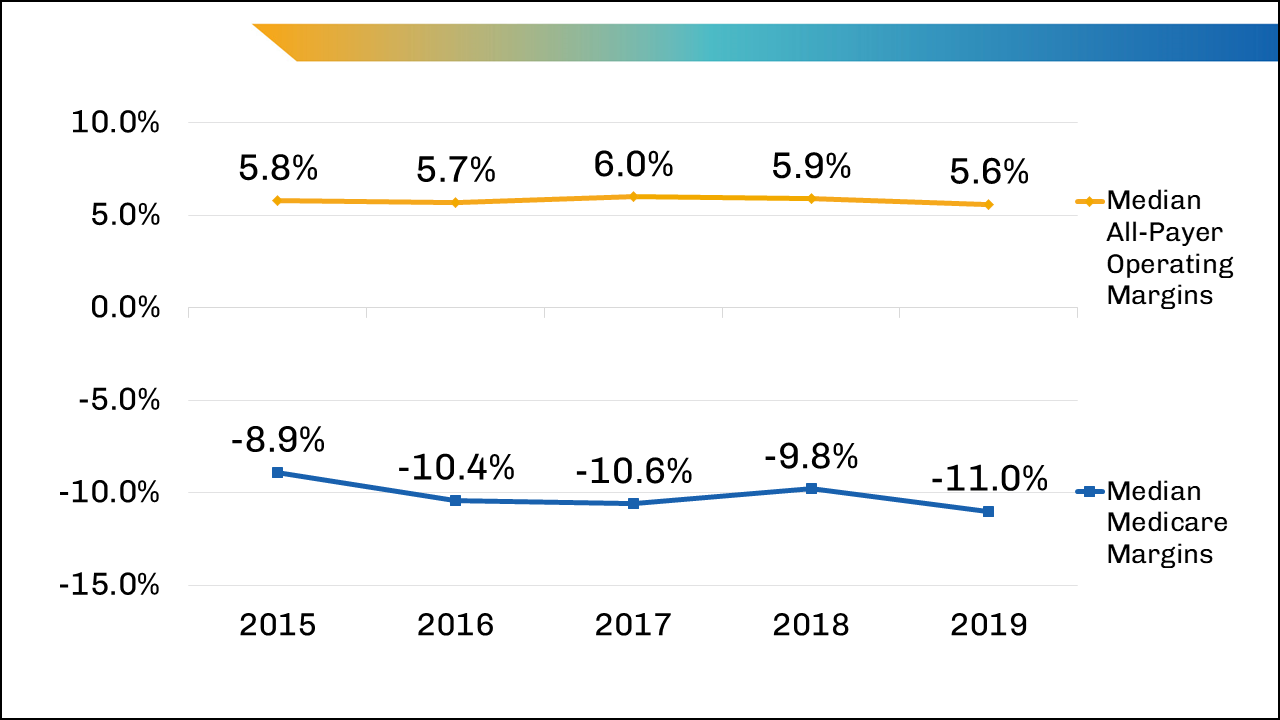

U.S. hospitals, on average, have negative Medicare operating margins, meaning they lose money on patients insured by Medicare because of the relatively low level of payment, with the median at -11.0% in 2019 (Figure 2). In contrast, the median all-payer operating margin — the profit margin for all insurance payments for all services — was 5.6% in the same year (Figure 2). Total revenue was high enough to keep the overall operating margin positive; hospitals rely on higher payments from private insurers and other sources of income to offset the operating losses associated with caring for publicly insured (and uninsured) patients.

Private Insurance Payments Offset the Money Lost Caring for Medicare, Medicaid, and Uninsured Patients

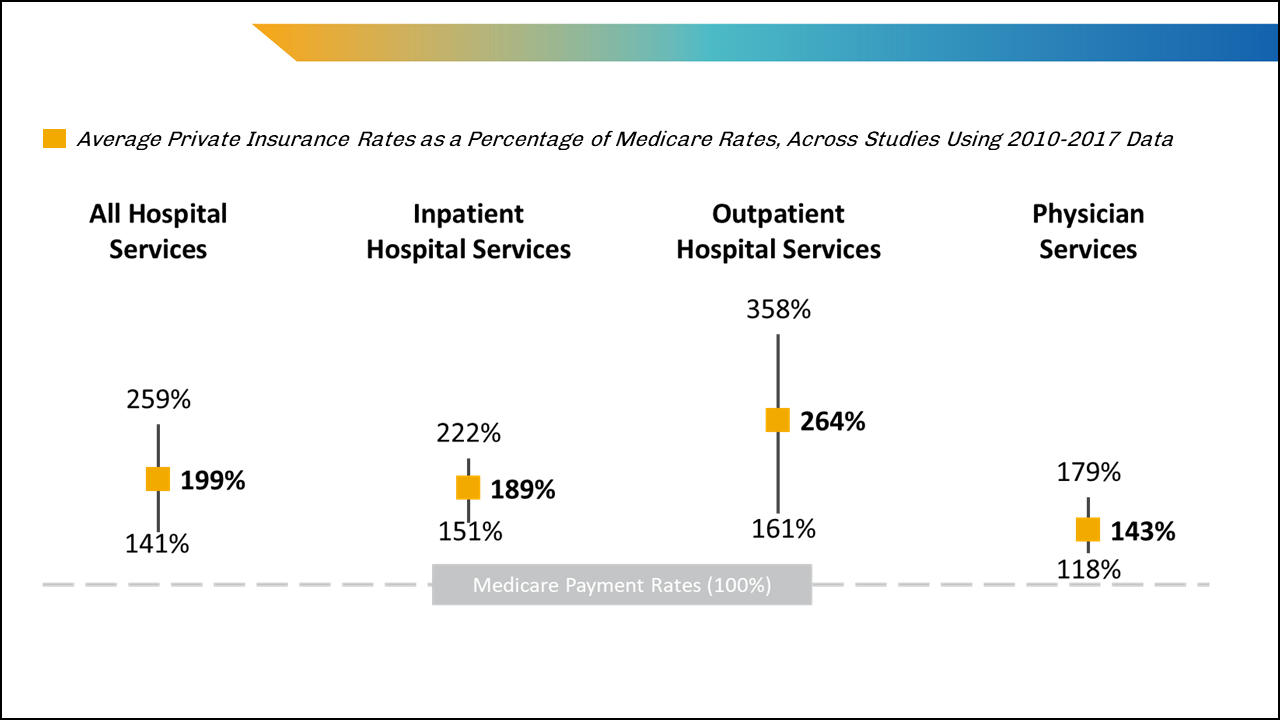

As of 2020, 67% of all hospitalized patients in the United States were covered through Medicare or Medicaid,15 which means many hospitals lost money on most patients they treated. How much they would lose if they were maximally efficient is debated among economists, but current median costs at U.S. hospitals remain higher than payments from Medicare. Figure 3 demonstrates that private insurance payment rates are about twice the rate Medicare pays and that outpatient hospital services have particularly high rates.16 The higher private insurance payments offset the losses from Medicare and Medicaid, whereas payments directly from patients to hospitals are a modest 2% of net patient revenue.15

The No Surprises Act will prevent some surprise bills from reaching patients, particularly bills from out-of-network providers. Although the low Medicare and Medicaid payment rates may lower spending for federal programs, they increase spending for all patients not on public insurance (and employers) and reinforce a health care financing system that harms low-income and medically underserved patients. Even if patients and their families may be better insulated from some out-of-pocket costs, policymakers need to address the negative margins resulting from public payments in health care, which are currently left to providers — and their billing systems — to deal with.

What happens when all insurers pay the same rate for hospital care? Providers do not need to negotiate rates with payers because hospital charges are less variable and more closely aligned with the actual costs of delivering care than when they pay different rates, as evidenced by the “all-payer” system in Maryland. That state’s system, developed as a pilot program under Medicare decades ago, notably does not decrease overall health care spending, but it does create more transparency in the billing process.17 However, other problems outside hospital care in Maryland remain, such as high drug costs and high out-of-pocket costs for mental health services.

It is critical for policymakers to understand the problems inherent to various health care financing arrangements and which of these problems can be influenced by public policy. High prices and highly varied charges for health care services are, in part, a function of underpayment for medical services by public insurance. While increasing public insurance payment rates should be part of national policy discussions, improving billing accuracy and lowering prices for consumers will not occur unless efforts are also made to reduce payment rates of other payers.

Notes

- KFF. State Health Facts: Health Insurance Coverage of the Total Population (CPS). https://www.kff.org/other/state-indicator/health-insurance-coverage-of-the-total-population-cps/. Published 2020. Accessed March 23, 2022.

- Murray R, King JS, Delbanco SF, et al. The state of state legislation addressing health care costs and quality. Health Affairs Blog. Aug. 22, 2019. doi:10.1377/hblog20190820.483741.

- Centers for Medicare & Medicaid Services. Overview of Rules and Fact Sheets. https://www.cms.gov/nosurprises/policies-and-resources/overview-of-rules-fact-sheets. Published 2022. Accessed Jan. 21, 2022.

- Pollitz K. No Surprises Act Implementation: What to Expect in 2022. San Francisco, CA: KFF. https://www.kff.org/health-reform/issue-brief/no-surprises-act-implementation-what-to-expect-in-2022/. Published Dec. 10, 2021. Accessed March 9, 2022.

- Congressional Budget Office. The Prices That Commercial Health Insurers and Medicare Pay for Hospitals’ and Physicians’ Services. https://www.cbo.gov/system/files/2022-01/57422-medical-prices.pdf. Published 2022. Accessed Jan. 21, 2022.

- Bai G, Anderson GF. US hospitals are still using chargemaster markups to maximize revenues. Health Affairs. 2016;35(9):1658–1664. doi:10.1377/hlthaff.2016.0093.

- Bai G, Anderson GF. Extreme markup: The fifty US hospitals with the highest charge-to-cost ratios. Health Affairs. 2015;34(6):922-928. doi:10.1377/hlthaff.2014.1414.

- Kliff S, Katz J. Hospitals and insurers didn’t want you to see these prices. Here’s why. New York Times. Aug. 22, 2021. https://www.nytimes.com/interactive/2021/08/22/upshot/hospital-prices.html. Accessed March 9, 2022.

- Evans M, Mathews AW, McGinty T. Hospitals often charge uninsured people the highest prices, new data show. Wall Street Journal. Jan. 6, 2021. https://www.wsj.com/articles/hospitals-often-charge-uninsured-people-the-highest-prices-new-data-show-11625584448?mod=hp_lead_pos5. Accessed March 8, 2021.

- While many hospitals have charity care programs to mitigate out-of-pocket costs for low-income patients, these programs do not fully address the financial burdens faced by many patients.

- Tolbert J, Orgera K, Damico A. What Does the CPS Tell Us About Health Insurance Coverage in 2020? San Francisco, CA: KFF. https://www.kff.org/uninsured/issue-brief/what-does-the-cps-tell-us-about-health-insurance-coverage-in-2020/. Published Sep. 23, 2021. Accessed April 21, 2022.

- The Commonwealth Fund. U.S. Health Insurance Coverage in 2020: A Looming Crisis in Affordability. https://www.commonwealthfund.org/publications/issue-briefs/2020/aug/looming-crisis-health-coverage-2020-biennial. Accessed Feb. 10, 2022.

- American Hospital Association. Underpayment by Medicare and Medicaid Fact Sheet. https://www.aha.org/system/files/media/file/2020/01/2020-Medicare-Medicaid-Underpayment-Fact-Sheet.pdf. Published February 2022. Accessed July 21, 2022.

- Medicare Payment Advisory Commission. Medicare Payment Policy: Report to Congress. Washington, DC: Medicare Payment Advisory Commission. https://www.medpac.gov/wp-content/uploads/2022/03/Mar22_MedPAC_ReportToCongress_SEC.pdf. Published March 15, 2022. Accessed March 22, 2022.

- AAMC Analysis of American Hospital Association (AHA) Annual Survey Database, FY 2020. Hospital counts reflect the total number of hospitals in the database and exclude federal hospitals, long-term-care hospitals, and specialty hospitals. https://www.ahadata.com/aha-annual-survey-database.

- Lopez E, Neuman T, Jacobson G, et al. How Much More Than Medicare Do Private Insurers Pay? A Review of the Literature. San Francisco, CA: KFF. https://www.kff.org/medicare/issue-brief/how-much-more-than-medicare-do-private-insurers-pay-a-review-of-the-literature/. Published April 15, 2020. Accessed March 22, 2022.

- As an example of transparency and differences in costs, a journalist compared her provider bills after moving to Maryland from New York City. Rosenthal E. A $1,775 doctor’s visit cost about $350 in Maryland. Here’s why. New York Times. Oct. 24, 2021. https://www.nytimes.com/2021/10/24/opinion/maryland-medical-bills-lower.html. Accessed March 22, 2022.